Is India struggling with stagflation?

10 June 2022 11:26 PM IST

The stagflation of the 1970s blessed us with the damaging wage and price controls and the utterly counterintuitive supply-side notion – famously drawn on a napkin – that cutting taxes would lead to higher tax revenues

"The stagflation of the 1970s blessed us with the damaging wage and price controls and the utterly counterintuitive supply-side notion – famously drawn on a napkin – that cutting taxes would lead to higher tax revenues" – Steven Rattner.

The damages of Covid-19, further fueled by adverse geopolitical influences, made many countries bankrupt. Covid-19 has not only left us with feeble growth but also, compounded with the Russia-Ukraine war, has a tighter grip on global financial growth.

The inflation rate has increased much above the tolerance level. With the opening and closing of Rupee at 77.68 and 77.71, things do not seem to be very favorable in India either.

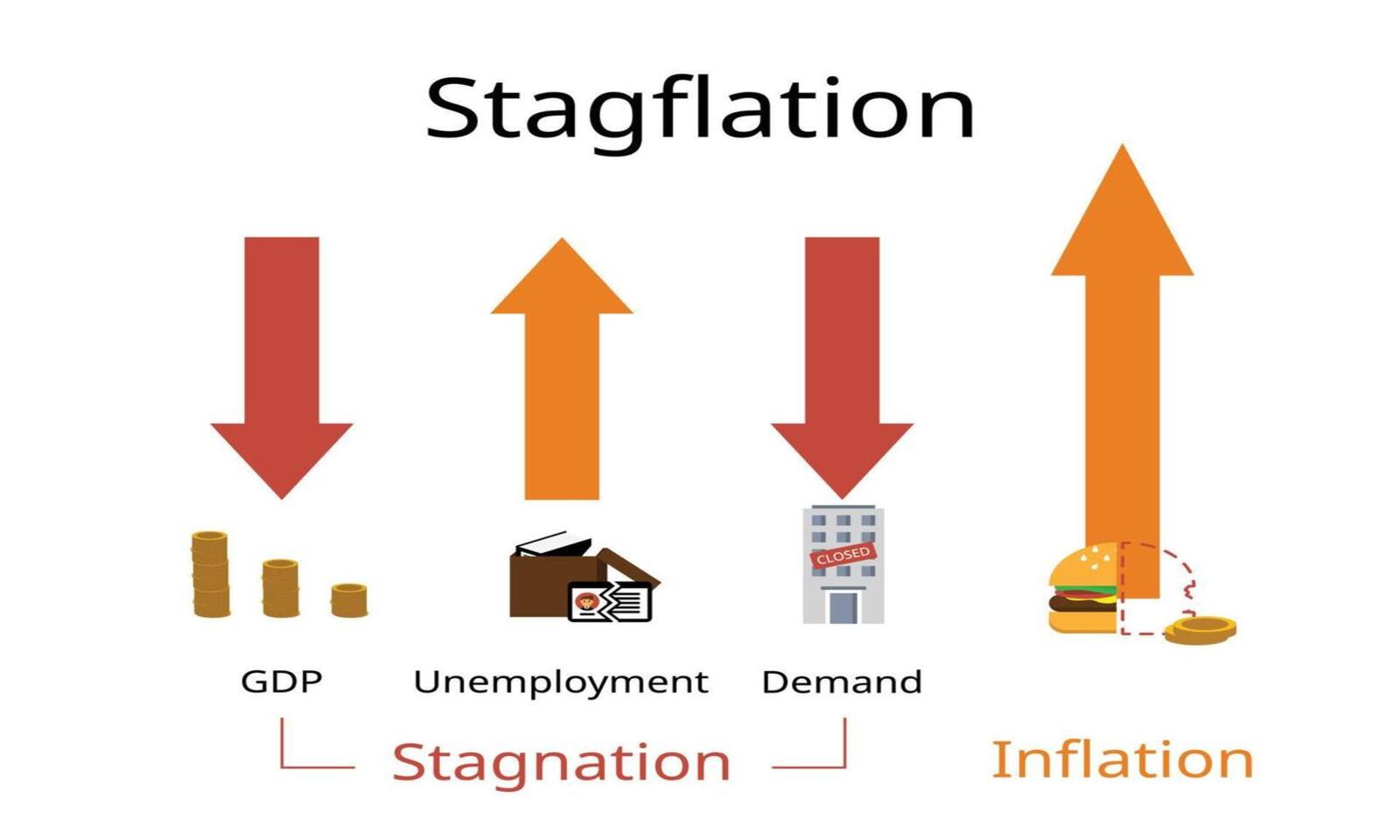

As per the World Bank, the economies will slip into inflation and may see the worst of stagflation. The world economy could never get time to recover because of the sequence of events. Pandemic shook up economies and added to it is a growing geopolitical crisis. Even if growth is seen, the target seems to be unachievable till 2023 and 2024. It's a testing time for India as it will have to navigate uncertainty and internal conflicts.

Along with the rise in communal riots, there is an upsurge in unemployment and a decline in the value of the Rupee. Even though the nation is progressing fast and keeping up the pace as a world leader, it is going to be unlikely for a common person to stay out of anxiety about uncertainty in the long term.

With the rate at which prices are increasing and GDP is weakening, the coming days are not expected to see some significant decline in the process. Even though the Indian economy will grow, the rate will be low and RBI also will not be able to do much in the situation. The only solution is to take charge of in-house production and stay local along with globalization.

It is going to be critical if the situation in India is not addressed timely by the policymakers. They have to redefine the models and understand the issue of unemployment and inflation. As one of the largest and youngest economies in the world, the proportion of unemployment in India is way ahead of many other developing economies. The only reason for this is the framing and following models of the west and not understanding the local situation of the country which is different. The untapped potential from the tier-2 and tier-3 cities and making them utilize their skillsets would have not only reduced unemployment but also contributed to the growth of GDP.

Higher unemployment rates in urban India are alarming during high inflation as it reflects non-engagement of resources in production and contribution to tax. The organizations in India and the job creators are still struggling with the primitive concepts of diversity, and claiming equality in urban cities has not given any significant boost to the Indian economy. It goes without saying the challenges of low GDP and a bigger resource pool of people could have been easily negotiated had the policy been framed as the different demographical changes in India.

Engaging more people constructively increases the supplies, and in-house production improves in-house operations and supply chain in every industry. This constitutes diversity and real responsibility at the organizational level. At any cost, the situation is in the hands of the policymakers to reframe policies and create a sound ecosystem to help fight against inflation in India and take corrective timely action before it escalates.

(Writer served as Major in Indian Army and is founder of Evolution Strategies, a thought leader and leadership coach)